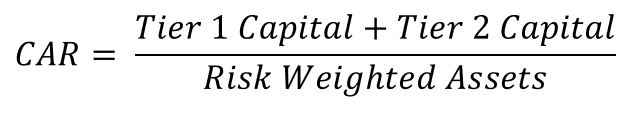

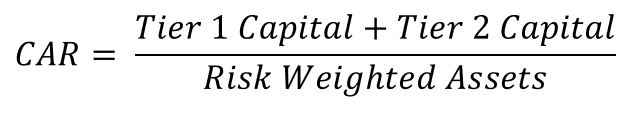

Capital Adequacy Ratio (CAR) is the ratio of banks capital to risk-weighted assets (RWA). CAR helps ensure that banks have sufficient capital to absorb a reasonable amount of losses and safeguard depositors’ money. It is decided by central banks and bank regulators to prevent commercial banks from taking excess leverage and becoming insolvent in the process. The Basel III norms stipulated a capital to risk weighted assets of 8%. However, as per RBI norms, Indian scheduled commercial banks are required to maintain a CAR of 9%.

Bank Capital

Bank Capital is the net worth of the bank or equity value to its investors. It is the difference between the bank’s assets and its liabilities.

Bank Capital = Assets – Liabilities

The Basel Committee classifies bank capital in 3 different levels:

Tier 1 Capital is the core capital of the bank. It represents the amount of capital that allows a bank to absorb losses without affecting the interests of depositors. Tier 1 capital consists of shareholders’ equity and retained earnings.

Tier 2 Capital is a supplementary component of the bank’s core base under the Basel accord which includes revaluation reserves, undisclosed reserve, general loss reserves, hybrid instruments, and subordinated debt instruments. Tier 2 capital absorbs losses in the event of a bank winding up or liquidating.

Tier 3 Capital is the capital that banks hold to support market risk in their trading activities. In Basel III norms, the Tier 3 capital has been eliminated.

Risk Weighted Assets (RWA)

Risk-weighted assets is a banking term that refers to an asset classification system. The classification of the assets is done based on the perceived risk. The higher the associated risk, the higher is the risk weightage. For e.g:

- Cash-in-hand has zero risks

- Sovereign Bonds have a relatively lower risk as they are backed by the Government

- Secured Loans have a relatively higher risk in comparison to Sovereign Bonds

- Unsecured Loans have the highest risk as there is no collateral

Simply put, Risk-Weighted Assets of a bank is the sum total of all the assets multiplied by their risk weights.

Note:

1. The risk weight for each asset class is provided by the Basel Committee.

2. There are certain off-balance sheet activities like Line of Credit, Letters of Credit, Revolving Credit. These credit equivalent facilities do not get in the balance sheet unless it is used by the borrower, as such they are called off-balance sheet items. However, the borrower can make use of the credit facility at any time in the future. As such, there is a potential risk associated with these credit equivalents. Each credit equivalent is therefore risk-weighted and added to the total Risk Weighted Assets (RWA) of the bank.

Usage of Risk Weighted Assets (RWA)

Risk-weighted assets are used to determine the minimum amount of capital that must be held by banks and other institutions to reduce the risk of insolvency.

Bank Liabilities

Liabilities are what the bank owes to others. The deposits in the bank accounts (Current Account, Savings Account, and Time Deposits) is a liability for the bank, as they owe it to their depositors. These deposits are also called Core Deposits of the bank as they form a stable source of funds for lending. Banks pay interest on the deposits to their Savings Account Holders and Term Deposit Holders. In turn, the bank uses depositors’ money to give loans to borrowers at a higher rate of interest and generate interest income. However, as a matter of prudence, the central bank prohibits the bank to use the entire depositors’ money for lending.

- Banks have to maintain a certain portion of deposits with the central bank. It is called the Cash Reserve Ratio (CRR) and is typically around 3%. Banks do not get any interest on this money.

- A certain portion of deposits has to be invested in liquid assets like Gold or Cash, Government treasury bills, and is called Statutory Liquidity Ratio (SLR). SLR is currently around 18%. The banks have to maintain a certain amount of deposits in cash at their branches / ATMs or with the central bank (Reserve Bank of India).

- Roughly the sum of CRR + SLR percentages is around 21%. Note: The central bank keeps changing the SLR and CRR to increase/decrease the liquidity.

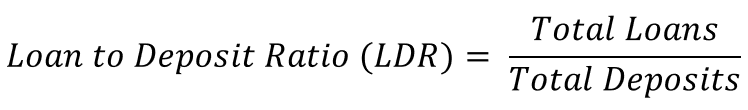

In summary, approximately only 80% of the total deposits are available with banks for lending. The ratio of total loans lent by a bank to total deposits is called Loan-to-Deposit Ratio (LDR). The ideal LDR for banks in India is around 70% – 72%.

Why Capital Adequacy Ratio Matters

Because it is a cushion for banks to absorb credit losses and ensure the safety of depositors. In case of a bank default, priority is given to the depositor’s money. The losses if any are first adjusted against the capital. The depositors may lose their money only if the losses exceed the capital. As such, the banks with higher Capital Adequacy Ratio provide a higher degree of protection to their depositors.

What if Bank’s CAR falls below Stipulated norms?

If the bank’s CAR falls below stipulated norms then, the bank will have to:

- Raise capital

- Securitize Loans

Remember the CAR formula, it is calculated as the ratio of Bank Capital to Risk Weighted Assets. In case the bank is unable to bring the CAR above the stipulated norms then, the central bank (RBI in India) can restrict the bank from any further lending and take control of the management. For e.g. In the year 2017, the RBI in India had put Central Bank of India, IDBI Bank, Indian Overseas Bank, and Uco Bank under Prompt Corrective Action (PCA) as their CAR fell below the stipulated norms.

Recent Comments