Data Engineering & Scorecard Development

for a Fintech Client

Requirement

1) Business & Operational MIS Automation

2) Risk & Marketing Scorecard Development

Solution Delivered

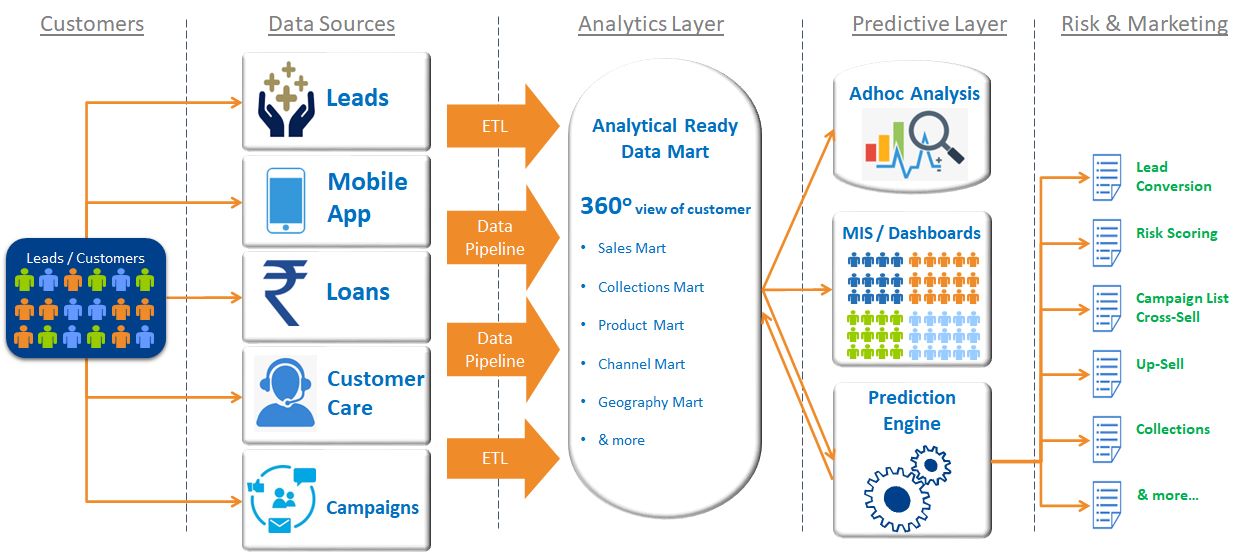

- Analytical Ready Data Mart for Credit Risk and Marketing Campaigns

- Borrower Single View to get a 360-degree view of borrowers

- Dashboards to track business growth

- Automated Scheduled Reports in MS Excel format emailed to Operational Users

- Focused Target Lists for Marketing Campaigns

- Credit & Collection Scorecard for Risk Management

- Bureau Reports Automation & Adhoc Analysis

Solution Framework

- Airflow was used to orchestrate the reporting workflow and scheduling purpose

- Data Engineering (ETL) code were all written in Python

- Power BI Dashboards were built for portfolio growth insights and analysis

- MySQL Database was used for data storage, data mart, and ARDM

- Credit Risk scorecards for automated decisioning were built using the Logistic Regression technique

- Collection Scorecard and Marketing Scorecards were developed using the XGBoost algorithm

- Customer Segmentation analysis was done using the K Means algorithm

Tech Stack

Airflow

Python

Power BI

PostgrSQL

PyTest

Watch more videos available on our youtube channel

Phone: 8939694874

Email : info@k2analytics.co.in

©2025 K2 Analytics. All rights reserved.